Japan’s stock market is one of the largest in the world, listing companies like Toyota, Sony, and Nintendo. For foreign investors, buying Japanese stocks is a way to access Asia’s second-largest economy while benefiting from global brands and innovative industries. But the process can feel intimidating if you’re new to international investing. Here’s a straightforward guide to help you understand how to buy Japanese stocks and what to keep in mind along the way.

Understanding the Japanese Stock Market

The core of Japan’s market is the Tokyo Stock Exchange (TSE), where most major companies are listed. It operates under the Japan Exchange Group and includes different sections: the Prime Market for blue-chip companies, the Standard Market for mid-sized firms, and the Growth Market for startups. Other exchanges exist, such as Osaka, Nagoya, and Sapporo, but the TSE is the main gateway for investors.

Trading hours follow Japan Standard Time, with a morning session from 9:00 to 11:30 and an afternoon session from 12:30 to 3:00. If you live abroad, that might mean trading happens overnight for you, which you must factor in when making investment decisions.

Can Foreigners Buy Japanese Stocks?

Yes, foreigners are allowed to buy Japanese stocks. In fact, international investors make up a large share of daily trading on the Tokyo Stock Exchange. There are two main ways to do it:

- Through Japanese brokerage firms: You open an account directly with a broker in Japan, though this usually requires a residence visa, a local address, and in most cases a hanko stamp for paperwork.

- Through international brokers: Many global platforms allow you to purchase Japanese shares directly, often in English, without needing to live in Japan.

If you’re based abroad, the second option is usually simpler.

The Most Popular Brokerages in Japan

If you decide to open a local account, three brokerages dominate Japan’s retail market.

SBI Securities is often considered the biggest online brokerage in the country, known for its low-cost trading and wide product range, from domestic equities to mutual funds and foreign currency investments.

Rakuten Securities has grown rapidly thanks to its integration with the Rakuten ecosystem. Investors can trade stocks while earning or redeeming Rakuten Points, making it a favorite among younger investors who already use Rakuten for shopping and travel.

Nomura Securities remains Japan’s largest traditional brokerage, offering full-service investment support, in-depth research, and wealth management. While its fees tend to be higher than online platforms, its reputation and extensive client services keep it at the top.

Together, these three account for a major share of retail trading and are the most common choice for residents who want direct access to Japanese stocks.

Buying Japanese Stocks via ADRs and ETFs

If opening an account in Japan feels too complex, you can still invest in Japanese companies through American Depositary Receipts (ADRs) or Exchange Traded Funds (ETFs) listed outside Japan. ADRs are stocks of Japanese companies like Sony or Toyota that trade on U.S. exchanges. ETFs, such as the iShares MSCI Japan ETF, provide access Japanese stocks without requiring you to pick individual shares.

This approach is especially popular for beginners who want Japanese exposure without worrying about language barriers or currency exchanges.

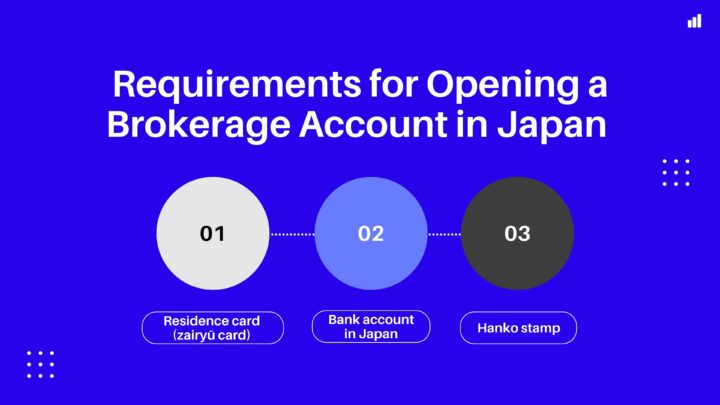

Opening a Brokerage Account in Japan

If you’re living in Japan and want to buy stocks directly, you’ll need a local brokerage account. Requirements usually include:

- Residence card (zairyū card) and a Japanese address.

- Bank account in Japan to fund trades.

- In some cases, a hanko stamp for signing official documents.

Taxes and Fees for Buying Stocks in Japan

When you buy Japanese stocks, you’ll face:

- Transaction fees: Brokerage commissions are charged per trade. Some brokers offer discount plans for frequent trading.

- Capital gains tax: Profits from selling stocks are taxed at around 20%.

- Dividend tax: Dividends from Japanese companies are also taxed at about 20%.

If you’re a resident, you might be able to use a NISA account (Nippon Individual Savings Account), which offers tax-free benefits on a limited amount of investments each year. Non-residents won’t qualify for this program.

Things to Consider Before Investing

Japan’s market is unique in several ways. Companies often have cross-shareholding structures, where firms own stakes in each other. Corporate culture can be conservative compared to the U.S., meaning slower changes in leadership or dividends. At the same time, Japan has strengths in technology, robotics, automotive, and consumer goods, sectors that remain globally competitive.

Currency is another factor. Since stocks are priced in yen, your returns may fluctuate depending on exchange rates with your home currency.

Alternatives if You Don’t Live in Japan

As well as ADRs and ETFs, another route is to buy shares in global companies that are heavily exposed to Japan’s economy, such as automakers or electronics firms. This indirect exposure still ties you to Japan’s growth while keeping your investments in your domestic market.

Buying Japanese stocks is entirely possible, whether you live in Japan or abroad. The simplest path for residents is opening a local brokerage account, while non-residents often find ETFs or ADRs more convenient. Before investing, take into account transaction fees, taxation, and currency exchange risks. With preparation and the right broker, Japan’s market can be an exciting addition to a global portfolio.