Japan has long been a top destination for tourism, but recently, it has captured the attention of international investors and lifestyle seekers for a different reason: real estate. With the Japanese yen remaining historically weak against the dollar and headlines circulating about affordable “ghost houses” (akiya) in the countryside, the prospect of owning a slice of Japan has never been more attractive.

Contrary to common belief, buying property in Japan as a foreigner is surprisingly straightforward. The market is transparent, well-regulated, and welcoming to international capital. However, navigating the bureaucratic hurdles, language barriers, and unique transaction costs require preparation.

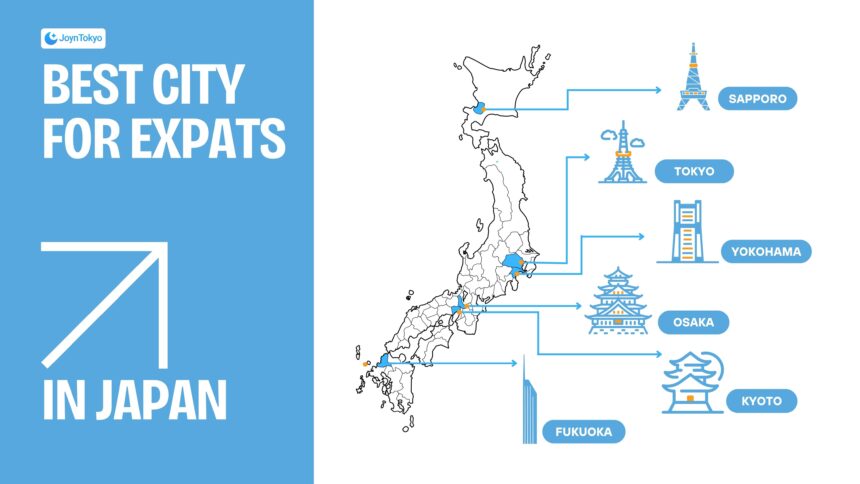

Whether you are looking for a ski chalet in Hokkaido, a sleek condo in Tokyo, or a renovation project in Kyoto, this guide covers everything you need to know to navigate the Japanese real estate market with confidence.

Can Foreigners Buy Property in Japan?

The short answer is yes.

Japan is one of the few Asian countries where foreigners can purchase property with virtually no restrictions.

- No Citizenship Required: You do not need to be a Japanese citizen.

- No Visa Required: You do not need a residence visa or even a work visa. You can buy property while on a standard tourist waiver.

- Full Ownership: You obtain freehold title to both the building and the land it sits on. There are no expiring leaseholds (unless you specifically buy a leasehold property) or government ownership of the land.

However, owning property does not grant you a right to live there permanently. Buying a house in Japan does not automatically qualify you for a residence visa. You will still need to comply with standard immigration rules if you plan to stay long-term.

The 7-Step Process to Buying a House in Japan

The purchasing timeline typically takes 1 to 2 months from offer to handover. Here is what to expect.

1. Find a Bilingual Real Estate Agent

The Japanese market is highly fragmented. While portals like Suumo or AtHome list thousands of properties, they are almost exclusively in Japanese. Furthermore, sellers are often hesitant to deal directly with foreigners due to language barriers.

Hiring a bilingual agent is crucial. They act as your bridge, negotiating on your behalf and translating the nuanced legal documents required for the sale.

2. Property Viewing

Once you identify potential properties, your agent will arrange viewings. If you are overseas, many agents now offer virtual tours via video call. This is the time to check for issues typical to Japanese homes, such as earthquake resistance standards (especially for homes built before 1981) and termite damage.

3. Submit a Letter of Intent (Purchase Application)

When you find the right property, you submit a “Purchase Application” (Kaitsuke Shoumeisho). This is a formal letter of intent that signals your seriousness to the seller. It acts as the starting point for negotiations regarding the price and handover date. This document is generally not legally binding, meaning you can still back out if you change your mind, though it is considered poor etiquette.

4. Explanation of Important Matters (Juyo Jiko Setsumei)

Before you sign the final contract, Japanese law requires a licensed real estate broker to provide a detailed explanation of the property. This document, called the Juyo Jiko Setsumei, covers critical details:

- Legal descriptions and title registration.

- Road access and boundary lines.

- Earthquake and disaster zones.

- Management fees (for condos).

This is often a long meeting where the agent reads the document aloud. Ensure you have a translated copy or a translator present so you understand exactly what you are buying.

5. Sign the Sales Contract and Pay the Deposit

Once you are satisfied with the Important Matters, you will sign the Sales Contract (Baibai Keiyaku-sho). At this stage, you must pay the deposit (teitsukekin), which is typically 5% to 10% of the purchase price.

Warning: Once this contract is signed and the deposit is paid, backing out without a valid legal reason usually means forfeiting your deposit.

6. Final Settlement and Handover

The final settlement (kessai) usually takes place a few weeks after the contract signing. This meeting involves you (or your proxy), the seller, the agents, and a Judicial Scrivener (Shiho-shoshi).

During this meeting, you transfer the remaining balance of the purchase price and all associated taxes and fees. Once the transfer is confirmed, the seller hands over the keys, and the property is effectively yours.

7. Property Registration

The Judicial Scrivener will register the transfer of ownership with the Legal Affairs Bureau. This updates the government registry to show you as the new legal owner. You will receive the title deed (Kenri-sho) a few weeks later.

Understanding the Costs: It’s Not Just the Price Tag

One of the biggest shocks for foreign buyers is the closing costs. You should budget an additional 6% to 10% of the purchase price to cover various taxes and fees.

Here is the typical breakdown:

- Brokerage Fee: The maximum legal fee is (Purchase Price × 3%) + 60,000 JPY + 10% Consumption Tax.

- Registration License Tax: Paid during the ownership transfer. This varies but is roughly 1.5% to 2% of the property’s government-assessed value.

- Judicial Scrivener Fee: Payment for the legal professional who handles the registration. Usually between 100,000 JPY and 150,000 JPY.

- Stamp Duty: A tax on legal contracts, typically ranging from 10,000 JPY to 30,000 JPY depending on the property price.

- Real Estate Acquisition Tax: This is a one-time tax billed several months after the purchase. It is calculated as 3% to 4% of the government-assessed value (which is usually lower than the market price).

Financing: Can You Get a Mortgage?

If you are a resident of Japan with a stable income and Permanent Residency (PR) status, you have access to ultra-low interest rates from Japanese banks.

If you are a non-resident living overseas, financing is significantly harder.

- Japanese Banks: Most domestic banks will not lend to non-residents.

- Foreign Banks in Japan: Some institutions (like Shinsei Bank or PRESTIA) may offer loans to foreign residents without PR, but the requirements are strict.

- Cash is King: The vast majority of overseas buyers purchase Japanese real estate with cash.

Read More

Legal Requirements for Non-Residents

If you live outside Japan, there are two specific bureaucratic items you must handle:

- Affidavit: Japanese residents use a registered seal (Hanko) for official documents. Since foreigners usually don’t have this, you will need a notarized Affidavit from your home country (or embassy) to validate your signature and identity.

- Tax Representative: If you buy an investment property to rent out, or simply need to pay your annual Fixed Asset Tax, you must appoint a Tax Representative (Nozei-kanrinin) in Japan to handle payments and correspondence with the tax office on your behalf.

- Post-Purchase Reporting: Under the Foreign Exchange and Foreign Trade Act, foreigners purchasing real estate may need to submit a report to the Ministry of Finance via the Bank of Japan within 20 days of the purchase. This is a simple formality, but it is a legal requirement.

Read More

Frequently Asked Questions

How to buy a house in Japan as an American?

The process for Americans is identical to any other foreigner. There are no specific treaties that make it harder or easier. However, Americans must be mindful of the exchange rate (USD to JPY) to maximize purchasing power. Additionally, you will need to report the foreign asset on your US tax returns if the value exceeds certain thresholds, so consult a US tax professional.

How much does it cost to buy a house in Japan?

Prices vary drastically by location.

- Rural “Akiya” (Ghost Houses): Can be found for as little as $10,000 USD to $50,000 USD, though they often require significant renovation costs.

- Tokyo Condos: A compact 1-bedroom apartment in central Tokyo might start around $300,000 USD, while luxury family apartments can easily exceed $1 million USD.

- Regional Cities: In cities like Osaka, Fukuoka, or Sapporo, you can often find decent family homes for $150,000 to $250,000 USD.

Read More

Is the buying process different for foreigners?

The core legal process is the same, but the documentation differs. Instead of a residence certificate and registered seal, you provide a passport and affidavit. The biggest practical difference is financing; while Japanese citizens take out 35-year loans with <1% interest, most non-resident foreigners must pay 100% cash upfront.

Start Your Journey

Japan offers a unique opportunity to own freehold property in a safe, stable, and culturally rich environment. While the paperwork may seem daunting, thousands of international buyers navigate this system successfully every year. With the right agent and a clear understanding of the costs, you can turn the dream of a Japanese home into a reality.