Understanding Japan’s insurance system is crucial for anyone living or planning to move to the country. Japan has a highly regulated insurance system that includes both mandatory and voluntary coverage. This guide will provide an overview of the different types of insurance available in Japan, their functions, and how foreigners can navigate the system effectively.

Understanding Japan’s Insurance System

Japan has a highly regulated insurance system designed to offer financial protection and medical support to residents. There are two main categories:

- Public (Social) Insurance: Provided by national or local governments, covering health, pension, and employment.

- Private Insurance: Offered by insurance companies for additional or specialized coverage.

Below is a detailed look at each category, along with unique insurance products you might not find elsewhere.

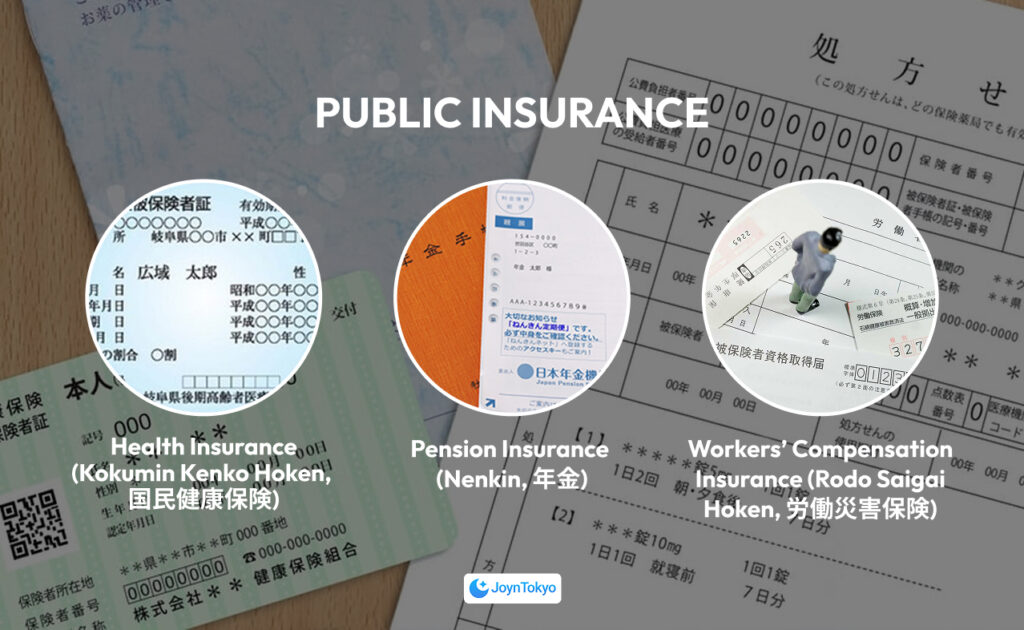

Public Insurance (Social Insurance)

Before diving into private plans, it’s essential to understand the core framework of Japan’s public insurance. Here, we will introduce health insuraance, pension systems, and other mandatory protections.

Health Insurance (Employees’ Health Insurance & National Health Insurance)

Health insurance is compulsory for all residents in Japan. There are two main types:

- Employees’ Health Insurance (Shakai Hoken, 社会保険) Provided through employers, covering employees and their dependents. Premiums are shared between the employer and employee, and coverage includes medical expenses, maternity benefits, and disability allowances.

- National Health Insurance (Kokumin Kenko Hoken, 国民健康保険) For self-employed individuals, students, and part-time workers. This insurance is managed by local governments, with premiums based on income and household size.

Under both systems, 70% of approved medical costs are generally covered, leaving you to pay 30% out-of-pocket. However, Japan offers a high-cost medical expense reimbursement system, which allows you to claim back expenses above a certain threshold.

(Reference: Ministry of Health, Labour and Welfare)

Pension Insurance (Nenkin, 年金)

Japan’s pension system provides financial support during retirement and is mandatory for residents aged 20 to 60.

- National Pension (Kokumin Nenkin, 国民年金): Targeted at self-employed individuals, students, and freelancers. Premiums are fixed nationwide, with possible government subsidies for those who cannot afford payments.

- Employees’ Pension (Kosei Nenkin, 厚生年金): Enrolled through your employer if you work full-time or meet specific conditions. Contributions are based on salary, matched by the employer, and generally yield higher benefits than the National Pension.

Mandatory for residents aged 20-60, pension insurance ensures financial support during retirement. There are two types:

(Reference: Japan Pension Service)

Employment Insurance (Koyo Hoken, 雇用保険)

Provides financial support for unemployed individuals who meet specific criteria. It covers job loss compensation, skill development programs, and job placement services.

Workers’ Compensation Insurance (Rodo Saigai Hoken, 労働災害保険)

Fully funded by employers, this insurance covers medical expenses, lost wages, and compensation if you suffer work-related injuries or illnesses.

(Source: Japan Pension Service, Ministry of Health, Labour and Welfare)

Private Insurance in Japan

While Japan’s public insurance system covers essential needs, many residents choose to supplement it with private insurance for additional security:

Medical Insurance (Iryo Hoken, 医療保険)

Covers additional treatments, hospital stays, and helps with the 30% co-payment required under public insurance. Some plans provide cash benefits for hospitalization or specific diseases such as cancer.

Life Insurance (Seimei Hoken, 生命保険)

Provides financial support to beneficiaries in case of death, with some policies including riders for terminal illnesses or disability.

Automobile Insurance (Jidosha Hoken, 自動車保険)

Compulsory Automobile Liability Insurance (Jibaiseki, 自係関係車保険): Mandatory for all vehicle owners. This only covers injuries to third parties.

Voluntary Automobile Insurance: Provides additional coverage for property damage, theft, and injury costs to oneself and others.

- Property and Liability Insurance Protects against fire, theft, and natural disasters. Some policies include coverage for earthquakes and typhoons, which are common in Japan.

(Source: Japan Insurance Association, Private Insurance Companies in Japan)

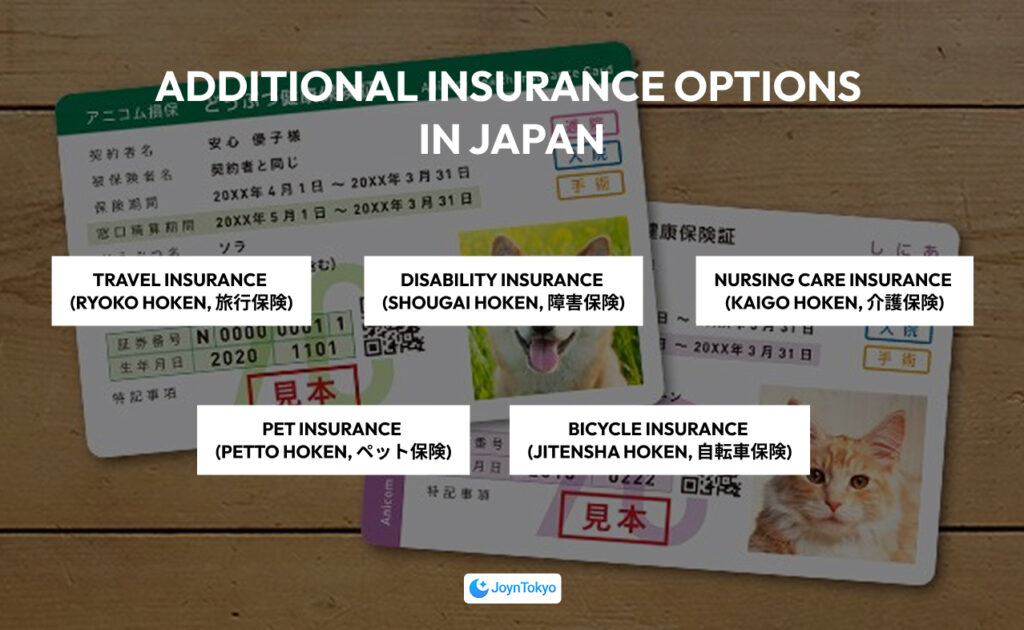

Additional Insurance Options

In addition to the core public and private insurance options, there are several other insurance types available in Japan:

Travel Insurance (Ryoko Hoken, 旅行保険)

Covers medical expenses, trip cancellations, lost luggage, and other travel-related issues. This is highly recommended for both domestic and international travelers.

Disability Insurance (Shougai Hoken, 障害保険)

Provides financial assistance in case of a severe disability that prevents the policyholder from working. Some policies offer lump-sum payments, while others provide monthly benefits.

Nursing Care Insurance (Kaigo Hoken, 介護保険)

Available for residents aged 40 and above, this insurance helps cover long-term care services for elderly individuals and those with disabilities. The system includes home-care support and nursing home coverage.

Pet Insurance (Petto Hoken, ペット保険)

Covers veterinary expenses and medical treatment for pets, which can be costly in Japan.

Bicycle Insurance (Jitensha Hoken, 自転車保険)

Mandatory in some prefectures, covering accidents involving bicycles, including liability for injuring others.

(Source: Japan Financial Services Agency, Major Insurance Providers)

Unique Insurance Types in Japan

Japan has some unique insurance policies that might be unfamiliar to foreigners:

Hole-in-One Insurance

Referred to as “Hole in One Insurance Japan,” this covers the celebratory expenses traditionally incurred after scoring a hole-in-one in golf. In Japan, it’s customary for the golfer to host a party or provide gifts, and this insurance helps offset those costs.

Earthquake Insurance

Highly recommended for homeowners due to Japan’s seismic activity. It covers damages from earthquakes, tsunamis, and volcanic eruptions.

Cancer and Critical Illness Insurance

Supplementary plans that provide lump-sum or monthly payments for serious illnesses, offering more extensive support than public health insurance alone.

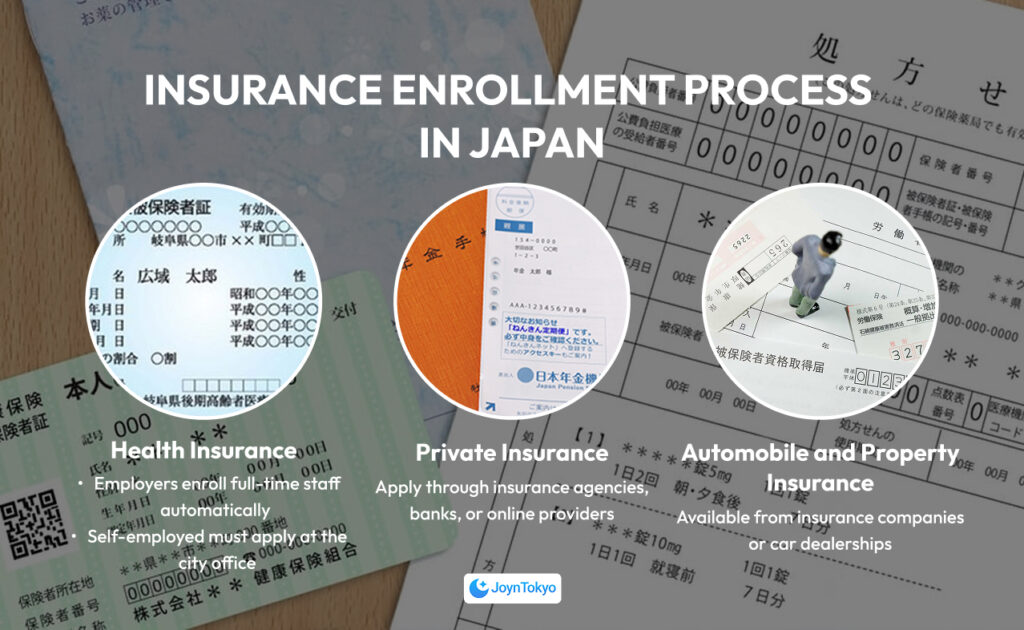

Enrollment Process in Japan

The process of enrolling in insurance depends on the type of coverage:

- Health and Social Insurance Full-time employees are automatically enrolled by their employers. Self-employed individuals must apply at their local city office.

- Private Insurance Available through insurance agencies, banks, or online providers.

- Automobile and Property Insurance Can be purchased from dedicated insurance companies or car dealerships.

Foreigners should ensure they register for the correct insurance type when moving to Japan and update their status if they change jobs or residency.

Insurance Payment and Refund Procedures

Understanding how insurance payments and refunds work in Japan is essential for managing your finances effectively.

Premium Payments

Insurance premiums for social insurance (health, pension, and employment insurance) are usually deducted from employees’ salaries. Self-employed individuals must pay their premiums directly to their local government office or pension agency.

Lump-Sum Withdrawal Payment

Foreigners leaving Japan permanently may be eligible for a Lump-Sum Withdrawal Payment from the pension system, provided they have contributed for at least six months. Additionally, some overpaid premiums, such as National Health Insurance fees, can be refunded if properly applied for before departure.

High-Cost Medical Expense Reimbursement

Japan has a system that reimburses individuals who incur exceptionally high medical costs. If a hospital bill exceeds a certain threshold, a portion of the excess cost can be reimbursed upon application.

(Source: Japan Pension Service, Local Government Offices, Health Insurance Providers)

Stay Protected and Plan Ahead

Japan’s insurance system is designed to provide financial security and medical support to all residents. Whether through public health insurance, social security, or private coverage, having adequate protection is essential for a stable life in Japan. Foreigners should take the time to understand their options, seek bilingual assistance if needed, and ensure they have the right coverage for their needs.