Setting up a business in Japan means navigating several layers of national and local taxation. This guide distils the 2025 rules into plain English so that founders, freelancers, and overseas managers can budget with confidence instead of dreading year‑end surprises.

The Japanese Business‑Tax Landscape

Japan does not levy a single “corporate tax” but rather a stack of five recurring charges that interact with one another. In practice, you will encounter the national corporate income tax; prefectural and municipal add‑ons known as local corporate and enterprise taxes; consumption tax, which is Japan’s value‑added tax; payroll‑related withholding and inhabitant taxes on salaries you pay yourself or employees; and finally fixed‑asset levies on property and equipment. Understanding how these components fit together is the key to accurate cash‑flow planning.

How National and Local Layers Combine

National corporate income tax (CIT) is calculated first. Local surcharges are then expressed as a percentage of that CIT or of “value added,” which means that the effective tax rate for a typical Tokyo‑based company currently falls somewhere between 30 % and 34 %. Businesses located in prefectures with lighter enterprise‑tax surcharges may shave one or two points off that headline figure.

Corporate Income Taxes

Although foreigners and Japanese firms follow identical rules, treaty relief can cut the cost of outbound dividends, interest, or royalties.

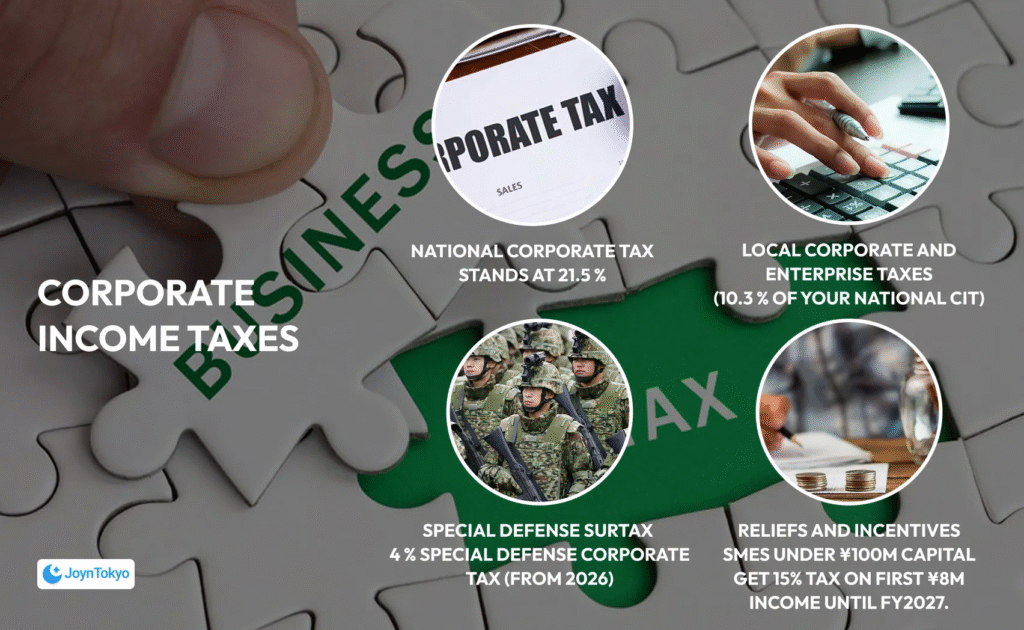

National Corporate Tax

For fiscal years beginning on or after 1 April 2024 the basic national rate stands at 21.5 %, a reduction designed to stimulate reinvestment.

Local Corporate and Enterprise Taxes

The national‑local corporate tax equals 10.3 % of your national CIT. An additional enterprise tax ranges from 3.4 % to 6.7 % for small and medium‑sized enterprises, while larger companies also pay up to 1.7 % on value added. These rates were last updated by the 2024 revision of the Local Enterprise Tax Act.

Special Defense Surtax (from 2026)

From fiscal years starting on or after 1 April 2026, companies will face a 4 % Special Defense Corporate Tax, although the first ¥5 million of taxable income is exempt to soften the impact on smaller entities.

Reliefs and Incentives

Japan tempers these headline rates with generous reliefs. SMEs whose paid‑in capital is below ¥100 million continue to enjoy a 15 % rate on their first ¥8 million of taxable income, a concession that now runs through fiscal year 2027. Highly profitable SMEs earning more than ¥1 billion will instead pay 17 % on that initial slice once the 2025 reform takes effect. Further down the return you can apply R&D, carbon‑transition, and regional‑investment credits that may offset as much as 20 % of the national tax due.

Filing and Payment Calendar

Timely filing prevents automatic penalties. Most foreign‑owned subsidiaries close their books on 31 December, so the diary dates below assume that year‑end.

Return Deadlines

| Tax | Due date | Extension available |

|---|---|---|

| Corporate, local, enterprise and consumption tax return | 28 February | One‑month extension on prior request (two months for consolidated groups) |

| Annual shareholder‑meeting minutes | Within 3 months of year‑end | — |

Estimated Payments

Whenever last year’s combined tax bill exceeded ¥200,000 you must pre‑pay twice: once six months into the current fiscal year and again one month after filing the final return. These instalments are credited against the eventual liability.

Penalties

Japan imposes a late‑filing surcharge that starts at 7 % and can rise to 14 % for extreme delays, while late payment attracts interest at the statutory rate, which is 1.2 % for 2025. Directors may become jointly liable if tax underpayment stems from gross negligence.

Personal Tax Considerations for Founder‑Employees

Many foreign owners draw a salary from their KK or GK and must therefore comply with Japan’s pay‑as‑you‑earn system. Employers withhold national income tax, which ranges from 5 % to 40 %, every payday and reconcile the totals in December. Prefectural and municipal authorities then bill inhabitant tax—roughly 10 % of the prior year’s income—in four instalments that begin the following June. Health, pension and unemployment insurance together cost around 14 % to 16 % of gross pay, split evenly between employer and employee.

Your residence status determines the scope of taxation. Non‑residents are taxed only on Japan‑source income, non‑permanent residents (those present for more than a year but less than five) are taxed on Japan‑source income plus any foreign income remitted to Japan, and individuals who have lived in the country for five years or more become subject to worldwide taxation.

Indirect Taxes Independent of Profit

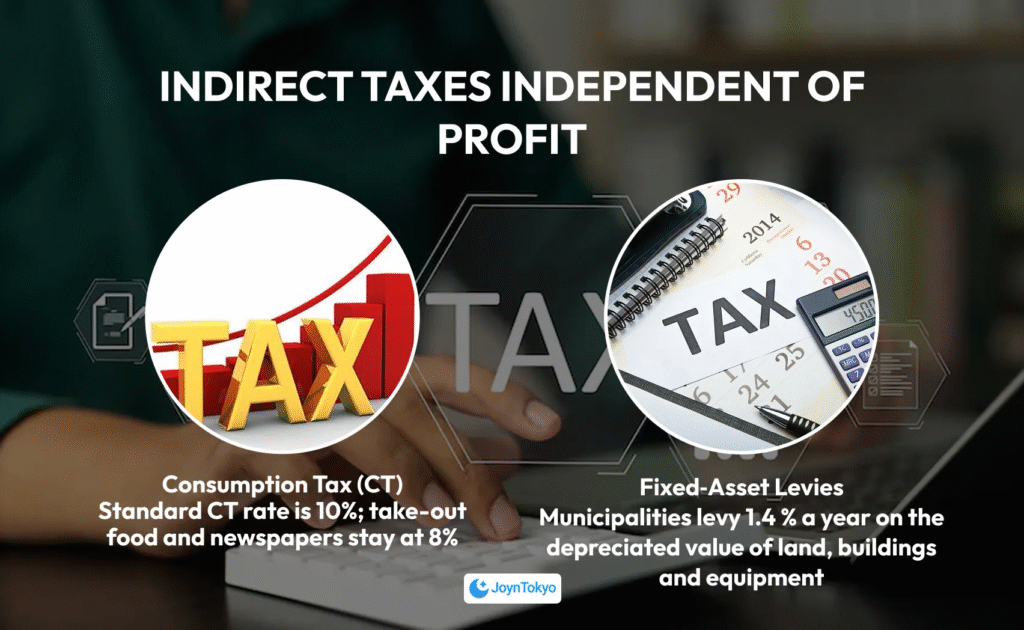

Consumption Tax (CT)

The standard CT rate remains 10 %, while take‑away food and newspapers stay at the reduced 8 % rate. Foreign SaaS providers must register and charge CT once their domestic sales exceed ¥10 million in any consecutive twelve‑month period.

Fixed‑Asset Levies

Municipalities levy 1.4 % a year on the depreciated value of land, buildings and equipment. In Tokyo an additional facilities tax applies to premises whose floor area exceeds statutory thresholds.

More Must Check Articles For Entrepreneurs

Check out our related articles for more practical knowledge as being an entrepreneur in Japan!