Moving to Japan means new rules, new paperwork — and also, a cash-heavy culture. Many are surprised by this, and so decide not to get a credit card at all; but a locally issued credit card can smooth rent deposits, online shopping and even train-ticket top-ups, while quietly building a domestic credit record. This guide will walk you through the essentials, then dive deeper into the cards most foreigners actually obtain.

Why a Japanese Credit Card Matters

Even in 2025, cash still dominates small purchases. Yet Visa, Mastercard and JCB terminals now appear in every convenience store. Paying with a domestic card avoids foreign-transaction fees, unlocks local reward schemes, and establishes trust with Japanese lenders — crucial if you plan to rent long-term or apply for a mortgage.

Key Benefits

- Lower fees: domestic billing in yen means no 2–3% FX surcharges.

- Rewards you can use: points convert to Suica top-ups, Amazon vouchers or air miles.

- Credit history: on-time payments feed the Personal Credit Information Centre, paving the way to car loans or premium cards.

Fast Comparison of Foreigner-Friendly Cards

Before we look at the mechanics, here is a bird’s-eye view of five cards foreigners routinely secure.

| Card | Annual Fee | Stand-out Perks | Ideal For |

|---|---|---|---|

| Rakuten Card | ¥0 | 1% base, 3× on Rakuten Ichiba, multilingual portal | Everyday spenders |

| EPOS Visa | ¥0 | Same-day issuance, 10% Marui Sale weeks, free travel cover | Shoppers in big cities |

| JCB Card W | ¥0 | Double points first year, 5-min digital number | 18–39 yr online users |

| Life Card | ¥0 | 1.5× first year, 3× birthday month | Students and newcomers |

| ANA VISA Wide Gold | ¥15,400 | 25% mileage bonus, lounges, 3-month travel insurance | Frequent flyers |

(Rates as of January 2025 – verify on each issuer’s site.)

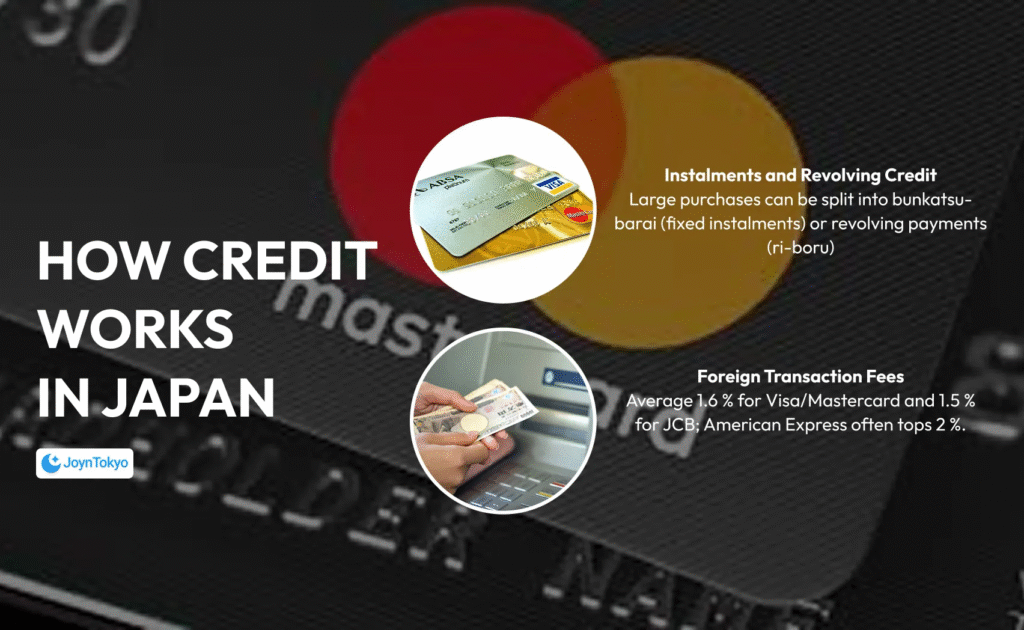

How Credit Works in Japan

Unlike the single FICO-style score familiar in the U.S., every Japanese issuer maintains its own internal rating, but reports payment behavior to two shared databases. Checking your own record is possible for ¥1,000 and a stamped envelope; correcting errors, however, can take weeks, so accuracy from day one is vital.

Instalments and Revolving Credit

Large purchases can be split into bunkatsu-barai (fixed instalments) or revolving payments (ri-boru). Typical interest ranges 12–16% p.a. Choose the “lump-sum” (ikkatsu/一括) option at checkout whenever you can.

Foreign Transaction Fees

Network surcharges in 2025 average 1.6% for Visa/Mastercard and 1.5% for JCB; American Express often tops 2%. When traveling abroad, a Wise or Revolution debit may still win on rate.

Card Networks and Local Brands

Visa and Mastercard acceptance is near-universal. JCB retains a loyal domestic base and sometimes runs 5% cashback at Seven-Eleven or Amazon.co.jp. Discover doubles as JCB in Japan, helpful for overseas visitors.

Eligibility Checklist for Foreign Residents

Before you click “Apply,” confirm these five basics:

- Residency and Address – at least three months’ stay and a registered address.

- Valid Residence Card – the front-and-back scan is mandatory.

- Domestic Bank Account – used for automatic monthly debits.

- Stable Income – payslips or tax notices; students may substitute a part-time contract.

- Japanese Contact Number and Language Declaration – issuers may call your workplace; confirm someone can answer in Japanese.

2025’s Best Cards Reviewed

Below we examine the five headline cards in detail, focusing on what matters to non-citizens.

Rakuten Card – Points Everywhere

No annual fee and a 1% base earn rate make this the default starter card. Rakuten Ichiba shoppers receive triple points, effectively 3%. Travel booked on the card triggers accident insurance up to ¥20 million.

EPOS Visa – Same-Day Plastic and Marui Perks

Apply at any Marui store, pass a 15-minute credit check and walk out with an active card. Four annual EPOS Sale periods slash 10% off almost everything in-store. Overseas purchases incur only the network FX rate — no issuer markup.

JCB Card W – Online Double-Point Dynamo

Exclusively online and free for life, Card W doubles points for the first 12 months and layers rotating partner promos up to 10%. Applicants must be 18–39. A digital card number arrives in five minutes, perfect for last-minute Shinkansen bookings.

Life Card – Low-Barrier Starter Choice

Life grants many students and first-year employees a modest ¥200k limit. Earn 1.5× points in the first year and 3× during your birthday month. Emergency overseas insurance covers up to ¥20 million for accidents.

ANA VISA Wide Gold – Mileage for the Jet-Set

With a ¥15,400 annual fee, Wide Gold suits travellers who earn at least 25% bonus miles on every ANA flight. Cardholders relax in domestic lounges and enjoy trip coverage for up to 90 days abroad. Typical approval requires one year of local employment and ¥3 million+ annual income.

Application Process: Step by Step

- Online Form – fill employer, visa type, income, expected spend (Japanese only).

- Upload Documents – passport, residence card, utility bill (PDF/JPEG).

- Phone Verification – issuer may ring your office, so give a Japanese-speaking colleague heads-up.

- Bank Link – enter your domestic bank’s branch code for automatic debits.

- Delivery – your physical card will arrive in 7 to10 days, whereas digital numbers often same day.

Using Your Card Wisely

Pay the full balance each month, keep utilisation under 30%, and your good behavior will be transmitted to national databases within 60 days. Missing a payment by even one day triggers a negative mark that lingers for five years.

Key Takeaways for 2025

- Start simple with Rakuten or EPOS to build history.

- Meet the five eligibility checks before applying.

- Avoid high-interest installments, and choose lump-sum when possible.

- Monitor FX fees if you travel, and carry a multi-currency debit as backup. Follow these steps and your shiny Japanese plastic will make life — not just payments — much smoother.

Happy swiping, and welcome to cash-lite living in Japan!