长期以来,日本一直是旅游胜地,但最近,它却因另一个原因吸引了国际投资者和生活方式追求者的目光:房地产。随着日元对美元汇率保持历史性的疲软,以及关于经济实惠的 “鬼屋”("ghost house")的头条新闻的流传,日本的房地产市场开始受到关注。akiya在农村,拥有一片日本的前景从未如此诱人。.

与人们的普遍看法相反,外国人在日本购买房产出奇地简单。日本市场透明、规范,对国际资本持欢迎态度。但是,要克服官僚主义障碍、语言障碍和独特的交易成本,则需要做好准备。.

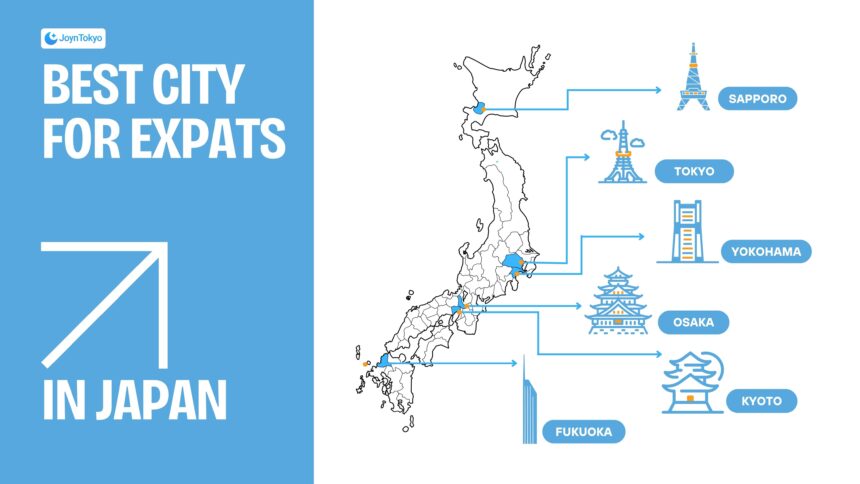

无论您是在北海道寻找滑雪小屋,还是在东京寻找时尚公寓,抑或是在京都寻找翻新项目,本指南都将为您提供在日本房地产市场上游刃有余所需的一切信息。.

外国人可以在日本购买房产吗?

简而言之,答案是肯定的。.

日本是少数几个外国人可以在几乎没有任何限制的情况下购买房产的亚洲国家之一。.

- 无需公民身份: 您不需要是日本公民。.

- 无需签证: 您不需要居住签证,甚至不需要工作签证。您可以在获得标准旅游豁免的情况下购买房产。.

- 完全所有权: 您可获得建筑物及其所在土地的永久产权。没有到期的租赁权(除非您购买的是租赁权房产),也没有政府对土地的所有权。.

但是,拥有房产并不意味着您有权在日本长期居住。在日本买房并不能自动获得居留签证。如果您计划长期居住,仍需遵守标准的移民规则。.

在日本买房的 7 个步骤

从报价到交房一般需要 1 到 2 个月的时间。以下是需要注意的事项。.

1.寻找双语房地产经纪人

日本市场高度分散。虽然 Suumo 或 AtHome 等门户网站列出了数千套房产,但几乎全是日文版。此外,由于语言障碍,卖家往往不愿直接与外国人交易。.

聘请一名双语代理人至关重要。他们是您的桥梁,代表您进行谈判,并翻译销售所需的细微法律文件。.

2.看房

一旦您确定了潜在的房产,您的中介就会安排看房。如果您身在海外,许多中介现在都可以通过视频电话提供虚拟看房服务。此时,您需要检查日本住宅的典型问题,如抗震标准(尤其是 1981 年以前建造的住宅)和白蚁危害。.

3.提交意向书(购买申请书)

找到合适的房产后,您需要提交一份 “购买申请”("Purchase Application")。Kaitsuke Shoumeisho).这是一份正式的意向书,向卖方表明您的诚意。它是就价格和交房日期进行谈判的起点。该文件一般不具有法律约束力,也就是说,如果您改变主意,您仍然可以退出,不过这被认为是一种不礼貌的行为。.

4.重要事项的说明 (Juyo Jiko Setsumei)

在您签署最终合同之前,日本法律要求有执照的房地产经纪人提供一份详细的房产说明。这份文件称为 Juyo Jiko Setsumei, 该手册涵盖了重要的细节:

- 法律说明和产权登记。.

- 道路出入口和边界线。.

- 地震和灾区。.

- 管理费(公寓)。.

这通常是一个漫长的会议,中介会大声朗读文件。确保有翻译件或翻译在场,这样您就能清楚地了解自己要买的是什么。.

5.签署销售合同并支付定金

一旦您对重要事项感到满意,您将签署销售合同(以下简称 "合同")。BAIBAY KEYAKU-SHO).在此阶段,您必须支付定金 (teitsukekin),通常是 购买价的 5% 至 10%.

警告 一旦签订了合同并支付了定金,在没有正当法律理由的情况下退房通常意味着没收定金。.

6.最终结算和移交

最终结算 (会场通常在签订合同几周后举行。参加会议的有您(或您的代理人)、卖方、中介和一名司法代笔人(Judicial Scrivener)。志保市).

在这次会面中,您将把剩余的购房款和所有相关税费转给卖方。一旦转账得到确认,卖方就会交出钥匙,房产实际上就属于您了。.

7.财产登记

司法代笔人将在法务局登记所有权的转移。这将更新政府登记册,显示您是新的合法所有人。您将收到地契(Kenri-sho)几周后。.

了解成本:不仅仅是价格标签

对于外国买家来说,最大的冲击之一就是过户费。您应额外预算 6% 至 10% 购买价的一部分,用于支付各种税费。.

以下是典型的细分情况:

- 中介费: 最高法律费用为(购买价格 × 3%)+60,000 日元+10% 消费税。.

- 注册许可税: 在所有权转让时支付。这笔费用各不相同,但大致为房产政府评估价值的 1.5% 至 2%。.

- 司法代笔费: 办理登记的法律专业人员的费用。通常在 100,000 日元至 150,000 日元之间。.

- 印花税: 法律合同税,通常为 10,000 日元至 30,000 日元不等,视房产价格而定。.

- 房地产购置税: 这是一种一次性税款,几个月后开具账单 后 在购买时。其计算方法为政府评估价值(通常低于市场价格)的 3% 至 4%。.

融资:您能获得抵押贷款吗?

如果您是日本居民,有稳定的收入,并且 永久居留权(PR) 您可以享受日本银行的超低利率。.

如果您是居住在海外的非居民,融资难度就会大大增加。.

- 日本银行 大多数国内银行不会向非居民贷款。.

- 日本的外国银行: 有些机构(如新生银行或 PRESTIA)可以向没有获得 PR 的外国居民提供贷款,但要求很严格。.

- 现金为王 绝大多数海外买家都用现金购买日本房地产。.

更多信息

对非居民的法律要求

如果您居住在日本境外,您必须处理两个特定的官僚项目:

- 宣誓书: 日本居民使用登记印章 (汉科)的官方文件。由于外国人通常没有这种证件,您需要本国(或大使馆)出具经公证的宣誓书,以验证您的签名和身份。.

- 税务代表: 如果您购买投资性房产用于出租,或只是需要缴纳年度固定资产税,您必须指定一名税务代表("税务代表")。Nozei-kanrinin)在日本代表您处理付款和与税务局的通信。.

- 购买后报告: 根据《外汇和外贸法》,购买房地产的外国人可能需要在购房后 20 天内通过日本银行向大藏省提交一份报告。这只是一个简单的手续,但却是一项法律要求。.

更多信息

常见问题

作为美国人如何在日本买房?

美国人的申请程序与其他外国人相同。没有具体的条约规定办理手续的难易。不过,美国人必须注意汇率(美元兑日元),以最大限度地提高购买力。此外,如果外国资产的价值超过一定的门槛,您需要在美国报税时申报,因此请咨询美国税务专业人士。.

在日本买房需要多少钱?

不同地点的价格差异很大。.

- 农村“秋叶”(《鬼屋》): 尽管通常需要大笔翻修费用,但也能以低至 $10,000 美元至 $50,000 美元的价格找到。.

- 东京公寓 东京市中心一套紧凑型一居室公寓的起价可能在 $30 万美元左右,而豪华家庭公寓则动辄超过 $100 万美元。.

- 地区城市: 在大阪、福冈或札幌等城市,您通常能以 $150,000 至 $250,000 美元的价格找到体面的家庭住宅。.

更多信息

外国人的购买过程是否有所不同?

核心法律程序相同,但文件不同。您需要提供护照和宣誓书,而不是居住证明和登记印章。最大的实际区别在于融资;日本公民可以获得 35 年期、利息<1% 的贷款,而大多数非居民外国人必须预付 100% 的现金。.

开始您的旅程

日本提供了一个在安全、稳定和文化丰富的环境中拥有永久产权房产的独特机会。虽然文书工作看似令人生畏,但每年都有成千上万的国际买家成功通过这一系统。有了合适的中介和对费用的清楚了解,您就可以将日本住宅的梦想变为现实。.