Tokyo is a city of contrast. It is where centuries-old shrines sit comfortably alongside skyscrapers, and where traditional craftsmanship commands as much respect as cutting-edge robotics. For entrepreneurs, this juxtaposition represents opportunity. The world’s third-largest economy offers a massive, sophisticated consumer base and a gateway to the Asian market.

However, navigating the Japanese bureaucracy can feel like trying to decipher a map written in a language you haven’t learned yet – often because it literally is. If you are wondering, “Can I start a business in Japan as a foreigner?” the answer is a resounding yes. While the process has distinct hurdles compared to other countries, the Japanese government, and the Tokyo Metropolitan Government in particular, have introduced measures to make the ecosystem more welcoming to foreign founders.

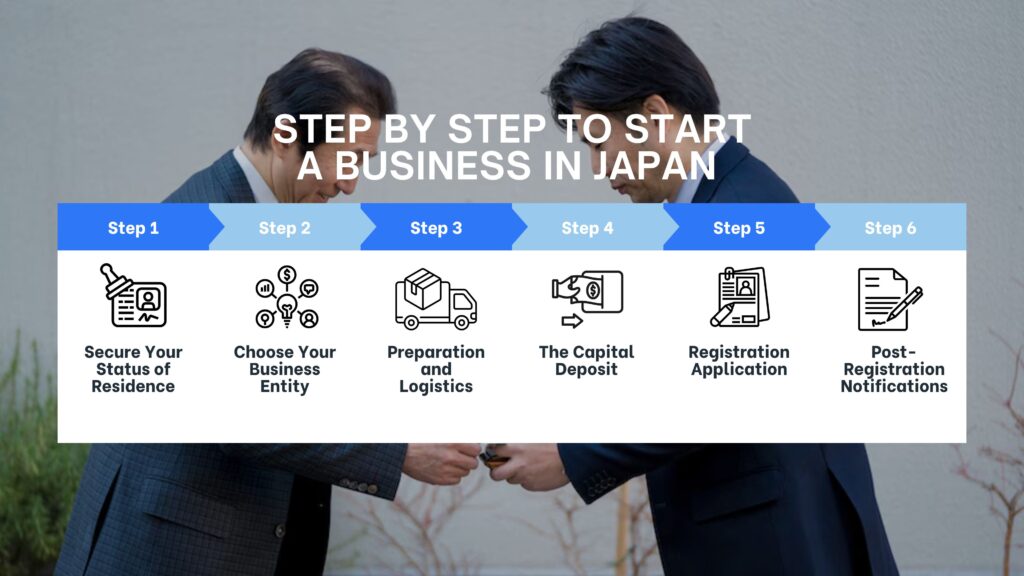

If you are moving to Japan to start a business or just curious, this guide breaks down the complex incorporation process into actionable steps.

Read More

Step 1: Secure Your Status of Residence

Before you sign a lease or print business cards, you must tackle the most critical hurdle: your visa. Japan requires specific residency status to generate income and sign contracts.

The Business Manager Visa

For most foreign entrepreneurs, the Business Manager status of residence is the golden ticket. To qualify, you generally need to meet several strict criteria:

- Capital Investment: You typically need to invest at least 5 million JPY (approximately $33,000 USD) into the business.

- Office Space: You must secure a dedicated, physical office space. A virtual office or a shared desk in a coworking space often does not meet Immigration Services Agency requirements.

- Staffing: Alternatively, if you cannot meet the capital requirement, you may qualify by employing at least two full-time employees who are residents of Japan.

Read More

The Startup Visa Option

If coming up with 5 million JPY and a physical office before you’ve even landed feels impossible, Tokyo offers a solution: the Startup Visa (Program for Increasing Foreign Entrepreneurs). This allows you to stay in Japan for up to six months (renewable up to one year) to prepare your business. It gives you the breathing room to open bank accounts and sign leases that would otherwise require a long-term visa.

Read More

Step 2: Choose Your Business Entity

Japan offers several types of corporate structures, but foreign entrepreneurs usually decide between two: the Kabushiki Kaisha (KK) and the Godo Kaisha (GK).

Kabushiki Kaisha (KK)

The KK is the traditional “Joint-Stock Corporation.” It is the most prestigious entity type in Japan.

- Pros: High credibility with Japanese clients and banks; easier to attract investors; perceived as stable.

- Cons: Higher registration costs; stricter compliance requirements (like publishing annual financial results); requires notarization of Articles of Incorporation.

Godo Kaisha (GK)

The GK is a “Limited Liability Company,” similar to an LLC in the US. This structure has gained popularity after Apple Japan and Amazon Japan reorganized as GKs.

- Pros: Lower setup costs; simpler ongoing management (no requirement to publish financials); flexible profit distribution.

- Cons: Slightly less prestige than a KK; investors may be less familiar with the structure.

Boost Your Chances of Finding the Right Opportunity!

Speak to our consultants to find out how you can start working in Japan!

Book Your FREE Consultation✓ 500+ Bookings as of 2026-03-03 ✓ English-speaking support

Step 3: Preparation and Logistics

Once you have your visa strategy and entity type, the groundwork begins.

- Seal the Deal (Literally): In Japan, signatures are often replaced by stamps called hanko. You will need a personal seal registered at your local ward office, and you will eventually need a set of corporate seals (Company Representative Seal, Bank Seal, and a Square Seal for invoices).

- Articles of Incorporation (Teikan): This document outlines your company’s purpose, trade name, and structure. It must be written in Japanese. If you are forming a KK, these articles must be notarized by a public notary. GKs skip the notarization step, saving roughly 50,000 JPY.

- Secure an Office: As mentioned, your visa depends on this. The lease usually needs to be in the company’s name, which creates a “chicken and egg” problem if the company doesn’t exist yet. Many founders sign a provisional contract as individuals and transfer it to the company later.

Read More

Step 4: The Capital Deposit

This is often the trickiest step for foreigners. To register the company, you must prove you have the necessary capital (e.g., the 5 million JPY). However, you cannot open a corporate bank account until the company is registered.

The standard workaround is to use a personal bank account in Japan. You (and any other investors) transfer the capital into this personal account and print the passbook or statement as proof of deposit. If you do not have a personal account in Japan yet, you may need a Japan-resident business partner to assist with this step.

Read More

Step 5: Registration Application

With your documents prepared, capital deposited, and seals ready, you file for registration at the Legal Affairs Bureau responsible for your district.

The registration tax generally costs:

- KK: Minimum 150,000 JPY (or 0.7% of capital).

- GK: Minimum 60,000 JPY (or 0.7% of capital).

Once the application is submitted, it takes about one to two weeks to process. The date you apply becomes your official date of incorporation.

Step 6: Post-Registration Notifications

You are a legal entity – congratulations! But the paperwork isn’t over. You must immediately file notifications with several agencies:

- Tax Office: Notify the National Tax Agency (NTA) and local tax offices of your establishment. This includes applying for the “Blue Return” status, which offers significant tax benefits.

- Social Insurance: You must enroll in the Social Insurance system (Health Insurance and Employees’ Pension Insurance) and Labor Insurance (Workers’ Accident Compensation and Employment Insurance). This is mandatory for all incorporated companies, even if you are the only employee.

- Bank of Japan: Depending on your industry and nationality, you may need to file a report regarding foreign direct investment under the Foreign Exchange and Foreign Trade Act.

How to Get Help: The Tokyo One-Stop

Does this process sound overwhelming? The Tokyo Metropolitan Government established the Tokyo One-Stop Business Establishment Center (TOSBEC) to help. Located in Akasaka, this center unifies the consultation windows for taxes, immigration, notarization, and social insurance into a single location. They provide free consultation for foreign entrepreneurs and can significantly demystify the process.

Starting a business in Tokyo is a marathon, not a sprint. It requires patience, attention to detail, and respect for procedure. But for those who navigate the initial bureaucracy, the reward is entry into one of the world’s most dynamic and loyal business environments.