Slowly but surely, Japan has embraced the cashless payment revolution. What used to be a cash-heavy country is now a place where you can glide through your day with just your phone or a credit card. This shift brings massive convenience for both residents and travelers: no more fumbling for coins or hunting down ATMs at midnight.

If you’re planning a trip, live here, or simply curious about how cashless payment in Japan works for foreigners, this guide breaks down every major option, from Suica cards to PayPay, and will help you figure out what works best for your stay.

What Payment Methods Does Japan Use Today?

Japan’s cashless transformation truly took off after 2018, when the government launched a national initiative to promote digital transactions. The goal? To make 40% of all payments in Japan cashless by 2025.

Since then, the options have exploded: credit cards, prepaid electronic cards, smartphone wallets, and QR-based payment apps are now everywhere. Still, cash hasn’t vanished completely, especially in small towns or mom-and-pop shops.

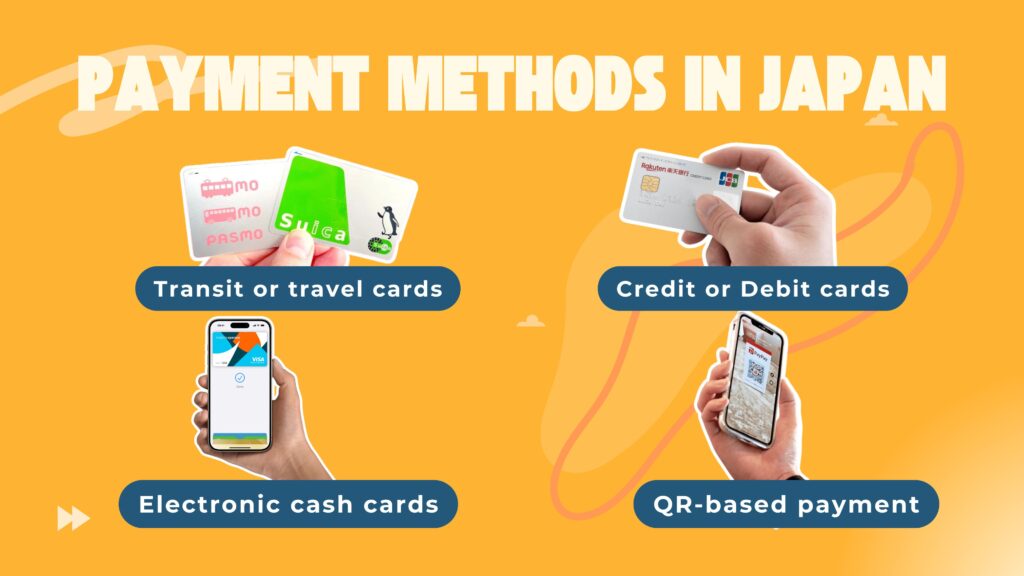

Here are the main categories of cashless payments in Japan today:

- Transit or travel cards (Suica, PASMO, etc.)

- Credit cards and debit cards

- Electronic cash cards

- Smartphone and QR-based payment apps

Let’s break each one down so you can see which fits your travel style.

Transit and Travel Cards: Suica, PASMO, and More

Public transport is Japan’s lifeblood, so it’s no surprise that train cards became the foundation of cashless living.

Suica and PASMO

Suica (by JR East) and PASMO are rechargeable IC cards that let you tap your way through train gates, buses, vending machines, convenience stores, and cafes. They’ve quietly become the most universal payment option for locals and visitors alike.

You can easily add Suica or PASMO to your Apple Wallet or Google Wallet, no physical card needed. Just tap your phone to pay for transport or snacks and watch the green light flash.

Suica and Pasmo are really convenient even if your phone battery dies, you can still tap and pay as long as the card is added to Apple Pay.

Welcome Suica for Travelers

Due to an ongoing IC chip shortage, physical Suica cards are limited. Instead, short-term visitors can pick up the Welcome Suica, available at Haneda and Narita Airports. It’s valid for 28 days and can be preloaded with amounts from ¥1,000 to ¥10,000.

If you want the simplest “cashless starter pack,” Suica on your phone is the best way to go.

Credit and Debit Cards in Japan

Credit cards have become the backbone of cashless Japan, especially in cities like Tokyo, Osaka, and Kyoto. Most hotels, restaurants, department stores, and chain cafes accept major cards like Visa, Mastercard, and American Express.

Still, not every terminal supports contactless tap-to-pay, especially in rural areas. You might need to insert your card or sign a receipt.

Pro tips:

- Visa tends to work most consistently for foreign cards.

- Always keep a little cash for countryside travel or smaller eateries.

- Foreign transaction fees can add up, so check to see if your bank offers a no-foreign-fee card.

Japan’s card culture is evolving fast, but it’s still wise to mix old-school and new-school payment methods.

Electronic Cash Cards

Electronic cash cards are prepaid systems often linked to major retailers or corporations. They function like stored value cards, and some even reward you with loyalty points for every purchase.

Popular examples include:

- WAON Card (Aeon Group) – widely accepted at supermarkets, malls, and convenience stores.

- Rakuten Edy – versatile prepaid card accepted at countless stores nationwide.

- Nanaco Card (7-Eleven) – easy to recharge and perfect for daily purchases.

These cards are ideal for residents or long-stay visitors who want a simple way to shop cashless and collect points at the same time.

Contactless Payment: Tap and Go in Japan

Most major cities now accept contactless payments via compatible credit cards, Apple Pay, and Google Pay. Still, smaller shops might use older machines that don’t recognize tap systems yet.

The good news: if your card or phone wallet supports Visa Touch, Mastercard Contactless, or iD/QUICPay, you’ll be able to tap for most purchases at convenience stores, chain cafes, and train stations.

You can also link your Suica, PASMO, or electronic cash cards directly to your smartphone wallet, turning your device into an all-in-one tap-to-pay tool.

Smartphone Payment Options

Japan has fully embraced the smartphone era. You can now use mobile apps to pay for food, transport, shopping, and more, often earning points in the process.

The most common systems include QR-based apps and digital wallets. While many Japanese apps require a local number or bank account, several global platforms now work seamlessly for visitors.

Read More

Popular Payment Apps in Japan

These smartphone payment apps have taken over Japan’s daily transactions: they’re quick, reliable, and often come with point rewards that can add up faster than you expect. Whether you’re a resident or a traveler, using one or two of these apps can make your stay infinitely smoother.

PayPay

If you only try one Japanese payment app, make it PayPay. It’s accepted at millions of locations, from convenience stores to boutique cafés.

PayPay works via QR codes. Simply scan, confirm, and you’re done. It’s also connected with AliPay and Kakao Pay, so visitors from China or Korea can use their existing accounts.

Each transaction earns PayPay points, which can later be redeemed for purchases or discounts.

Rakuten Pay

Backed by Rakuten, one of Japan’s tech giants, Rakuten Pay rewards users generously. You earn 1% points per transaction, or 1.5% if you link a Rakuten Card.

The app uses QR codes and is widely accepted across Japan. Even many independent stores and izakaya bars display Rakuten Pay stickers at their registers.

dPay

Operated by NTT Docomo, dPay is accepted at over four million stores. It’s deeply integrated into daily life, especially if you already use a dPoint Card to collect loyalty points.

You can pay at major chains like FamilyMart, Lawson, and Matsumoto Kiyoshi, and watch your points stack up quickly.

MerPay

If you use Mercari, Japan’s secondhand marketplace app, you’ll love MerPay. It lets you use your sales balance to make real-world payments, no transfer required.

You can also use coupons and discounts within the app and even pay at any store that accepts dPay, thanks to a partnership between the two services.

au Pay

A solid all-rounder, au Pay supports QR payments at more than five million locations. It ties into Ponta points, which can be redeemed at chains like Lawson and KFC.

If you’re staying in Japan longer, the au Pay Card offers bonus points and acts like a hybrid between a credit and payment app.

International Payment Apps That Work in Japan

These global payment apps are perfect for short-term visitors or business travelers who want to use familiar systems without setting up local accounts. Many major retailers, convenience stores, and shopping malls in Japan now support them, especially in Tokyo, Osaka, and Kyoto.

Read More

Alipay+

Alipay+ is widely accepted in large cities and tourist-heavy spots. You’ll find it at Don Quijote, convenience stores, and even 100-yen shops. You can link your home credit card and pay seamlessly.

It’s especially convenient for travelers from China or Southeast Asia who already use Alipay.

Read More

WeChat Pay

WeChat Pay works similarly, letting you pay by scanning QR codes at stores, restaurants, and even vending machines. You can link your credit card and use it without setting up a local bank account.

It’s handy for group travel too, as the app allows easy peer-to-peer transfers for splitting bills.

FamiPay

Exclusive to FamilyMart, FamiPay is a niche but useful option if you’re a frequent visitor. You’ll earn points for every purchase, and those points can be used for discounts on future snacks and drinks.

If you don’t have a Japanese bank account, you can recharge your FamiPay balance directly at the register.

Japan’s digital payment landscape is both modern and uniquely Japanese, a blend of precision, patience, and quiet innovation. Cash still has its place, but the convenience of cashless living is undeniable. From Suica to PayPay, it’s never been easier for foreigners to pay, travel, and shop without handling coins.

So, before your trip, load up your wallet app, grab a Suica card, and get ready to experience Japan’s cashless revolution, one effortless tap at a time.