Once city hall registration is complete, two things suddenly become possible. Opening a bank account and getting a Japanese phone number. In Japan, they are foundations because rent payments, salaries, utilities, online services, and even basic identity verification all depend on them.

This step in the roadmap explains how to approach both, which order makes things easier, and which options are most realistic for newcomers.

Why These Two Things Are So Closely Linked

Banks and phone companies rely on each other for verification. Many banks want a Japanese phone number. Many phone companies want a Japanese bank account or credit card. Knowing which options work for foreigners saves time and frustration.

In most cases, getting a phone number first makes the banking process smoother.

Speak To Our Consultants To See How You Can Successful Relocate to Japan

Arrive in Japan ready to live long-term. No scrambling. No confusion. Step into Japan with your life already lined up.

Book Your FREE Consultation →✓ English-speaking support ✓ 500+ Bookings

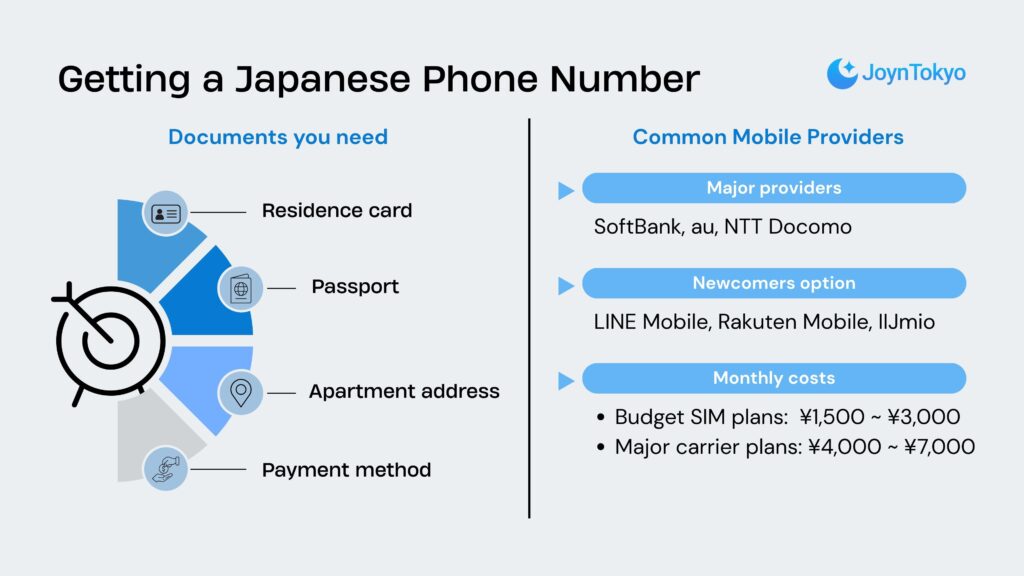

Getting a Japanese Phone Number, Your Fastest Win

A Japanese phone number is often easier to obtain than a bank account, especially if you start with a SIM only or prepaid option. Physical stores can verify documents on the spot, which helps avoid online rejection loops.

Your visa length and residence status affect which plans you qualify for.

You will usually need

- Residence card

- Passport

- Registered address

- Payment method, depending on the provider

Common Mobile Providers and Why People Choose Them

Major providers include:

- SoftBank – Wide coverage and good foreigner support in stores

- au – Strong network quality and stable service

- NTT Docomo – Largest network and strong rural coverage

Common alternatives for newcomers include:

- LINE Mobile or LINEMO – Simpler plans and online signup

- Rakuten Mobile – Lower cost and easier entry for some foreigners

- IIJmio – Flexible SIM only plans with lower fees

Monthly costs vary by plan:

- Budget SIM plans, roughly ¥1,500 to ¥3,000 per month

- Major carrier plans, roughly ¥4,000 to ¥7,000 per month

Prepaid and SIM only plans are often the easiest starting point.

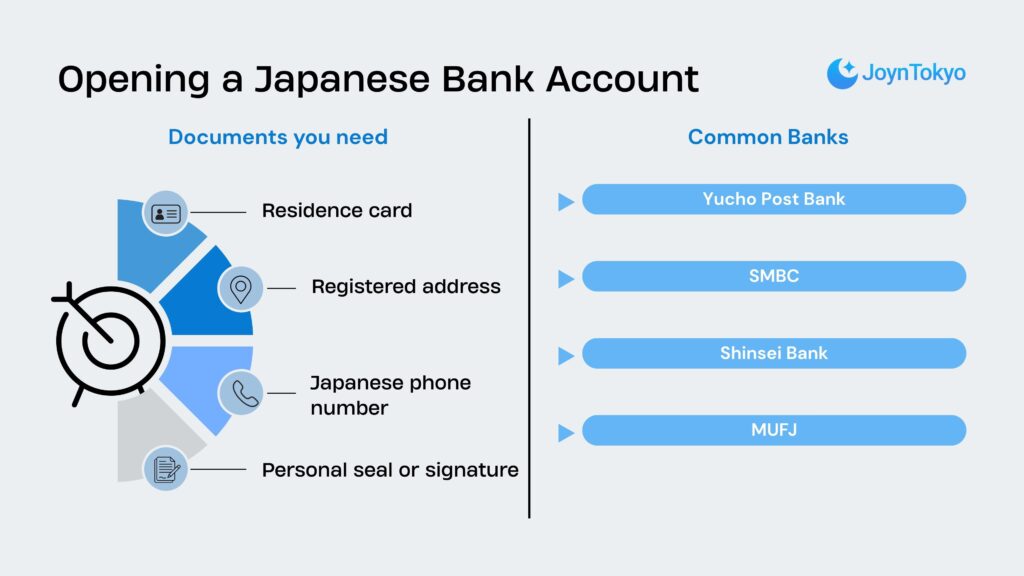

Opening a Bank Account

Opening a bank account in Japan can be straightforward or difficult depending on timing, visa type, and bank choice. Some banks are more foreigner friendly than others, especially for new residents.

Most banks require that you have lived at your address for a short period, though policies vary.

You will usually need:

- Residence card

- Passport

- Registered address

- Japanese phone number

- Personal seal or signature

Read More

Common Banks for Foreign Residents and Their Benefits

Japan Post Bank is one of the most accessible options. It has branches everywhere and relatively flexible requirements. It works well for receiving salary and paying bills, though online features are limited.

SMBC Prestia is designed for international clients. English support is strong and overseas transfers are easier. Minimum balance requirements may apply.

Shinsei Bank is popular with foreigners due to its English interface and international remittance options. It is often easier to use for online banking.

MUFJ is one of Japan’s largest banks. While not foreigner focused, it is widely accepted by employers and landlords. English support varies by branch.

Read More

Common Reasons Applications Are Rejected

Rejection is frustrating but common. It usually comes down to risk policies rather than personal background.

Common issues include:

- Very short remaining visa duration

- No Japanese phone number

- Recent arrival with no local history

- Incomplete or unclear documentation

Trying another branch or bank often solves the issue.

Linking Your Bank Account to Daily Life

Once your account is open, you can set up automatic payments for rent and utilities, receive salary, and verify identity for many services. This single step unlocks much of Japan’s administrative system.

Choosing the Right Order and Expectations

For most newcomers, the smoothest path is phone number first, then bank account. Do not aim for perfection on day one. A basic setup that works is far better than waiting weeks for an ideal option.